Michigan Estimated Tax Form 2024

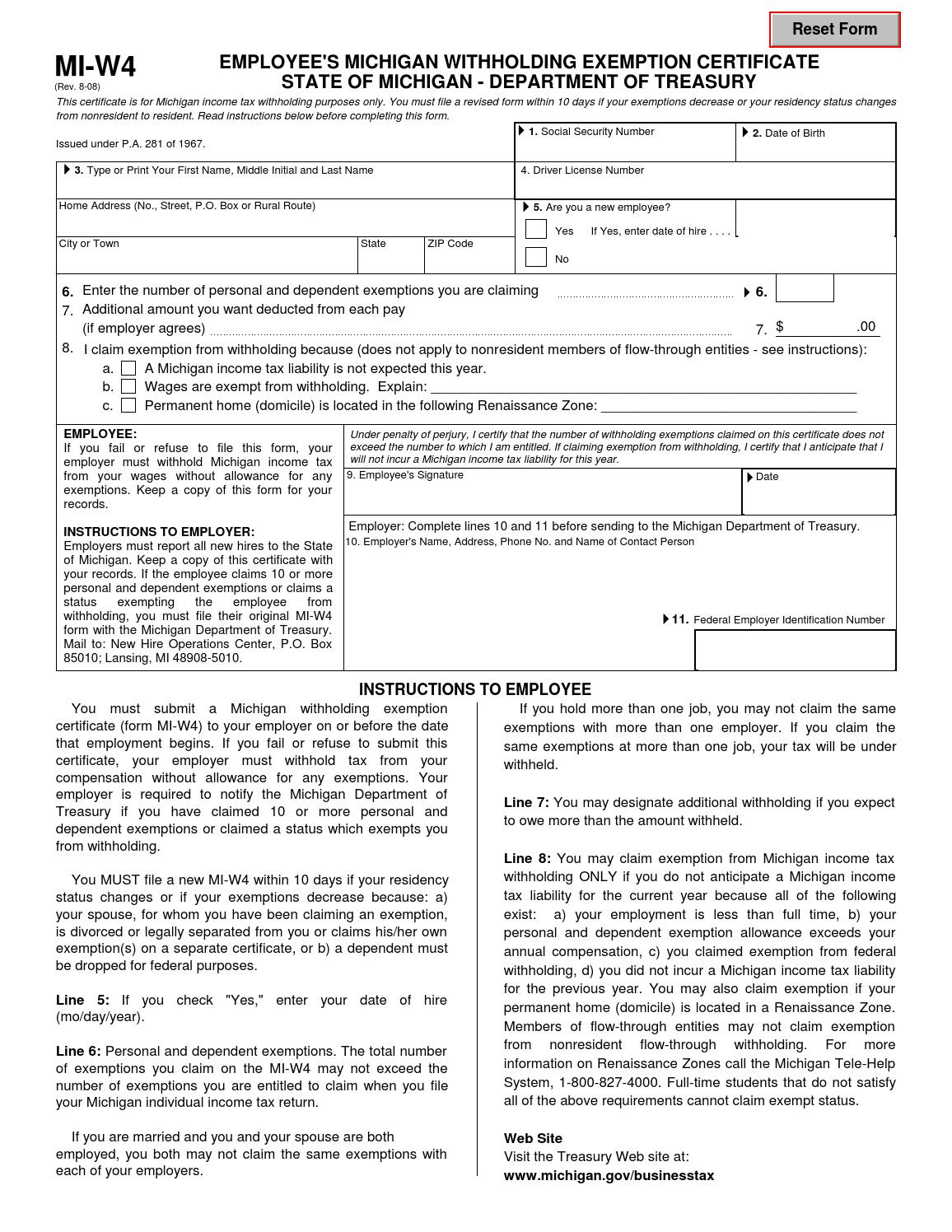

Michigan Estimated Tax Form 2024. Estimated tax penalty and interest calculator; The 2024 tax rates and thresholds for both the michigan state tax tables and federal tax tables are comprehensively integrated into the michigan tax calculator for 2024.

Michigan has a flat income tax system, which means that income earners of all levels pay the same rate: Following recent disasters, eligible taxpayers in tennessee, connecticut, west virginia, michigan, california and washington have an extended deadline for 2024.

Michigan Estimated Tax Form 2024 Images References :

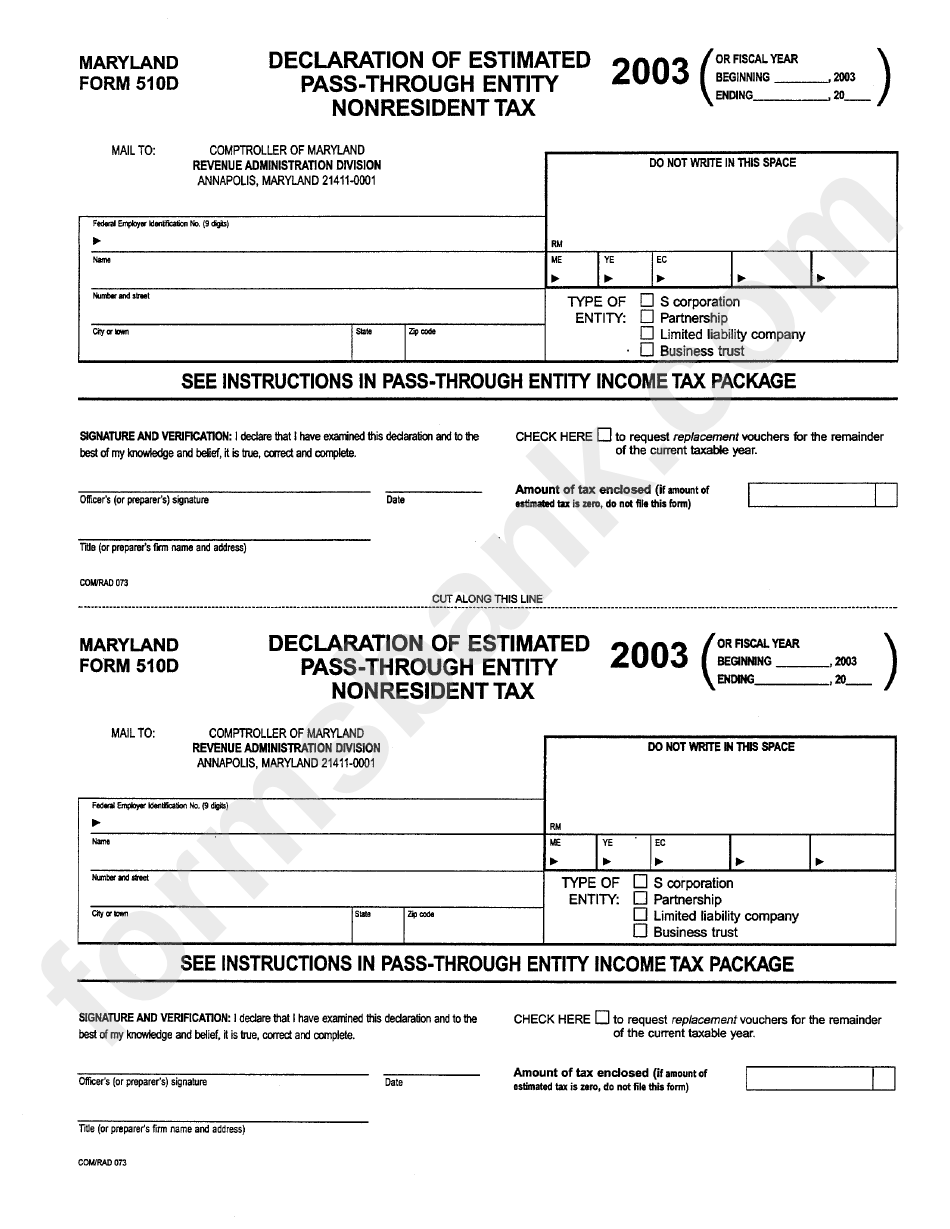

Source: maribelwrana.pages.dev

Source: maribelwrana.pages.dev

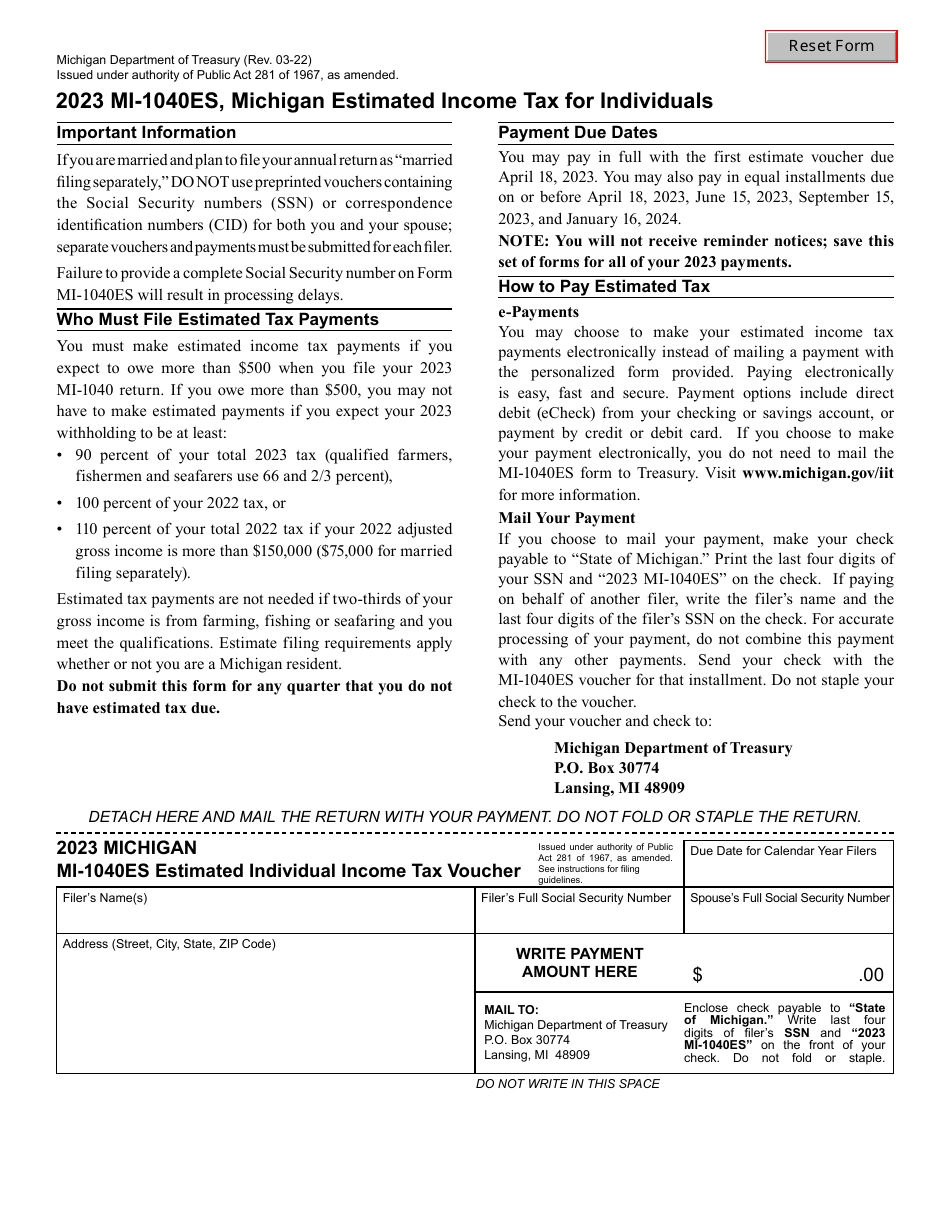

Michigan Estimated Tax Payments 2024 Form Greer Krista, Any altering of a form to change a tax year or any reported tax period outside of the stated year of.

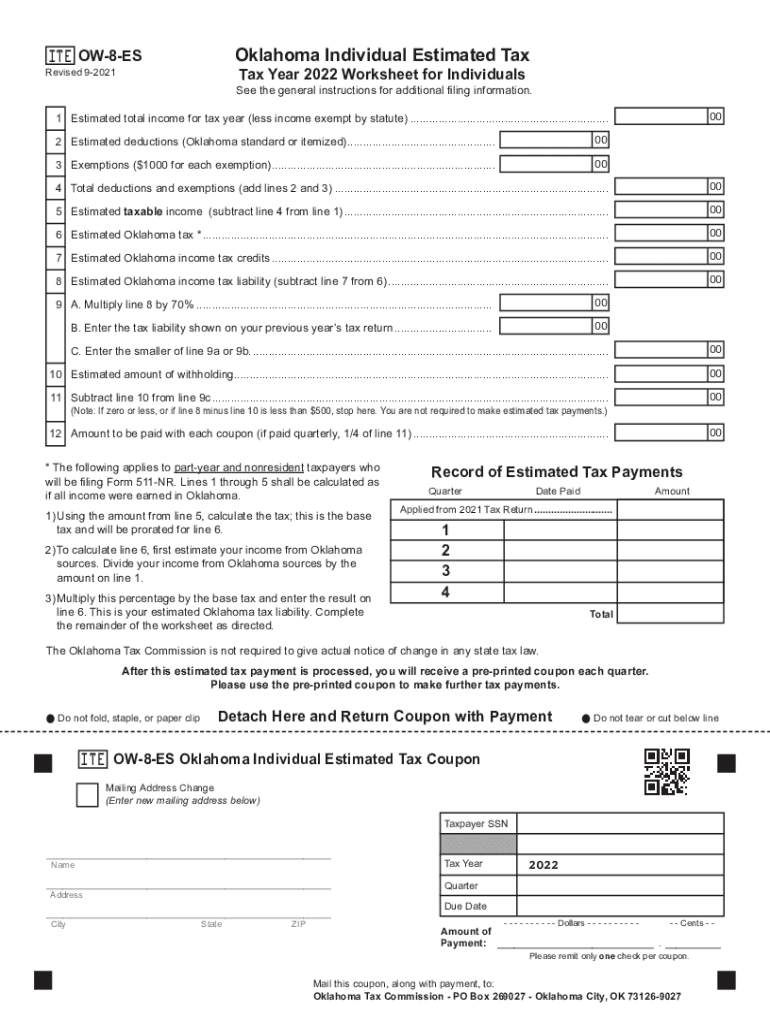

Source: geriannewdrucie.pages.dev

Source: geriannewdrucie.pages.dev

Michigan Quarterly Tax Form 2024 Libbi Roseanne, A michigan state tax return is due april 15, 2024, unless you file for an extension.

Source: clarybmaressa.pages.dev

Source: clarybmaressa.pages.dev

Estimated Tax Payments 2024 Dates And Forms Hali Prisca, Calculate your michigan state income taxes.

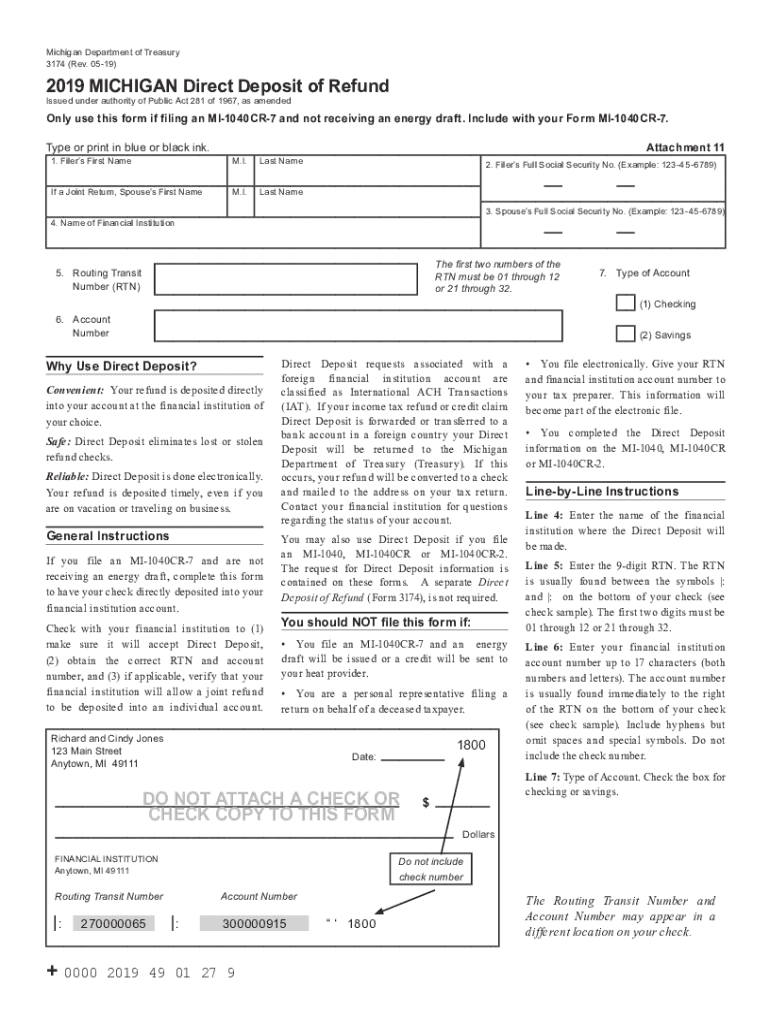

Source: www.templateroller.com

Source: www.templateroller.com

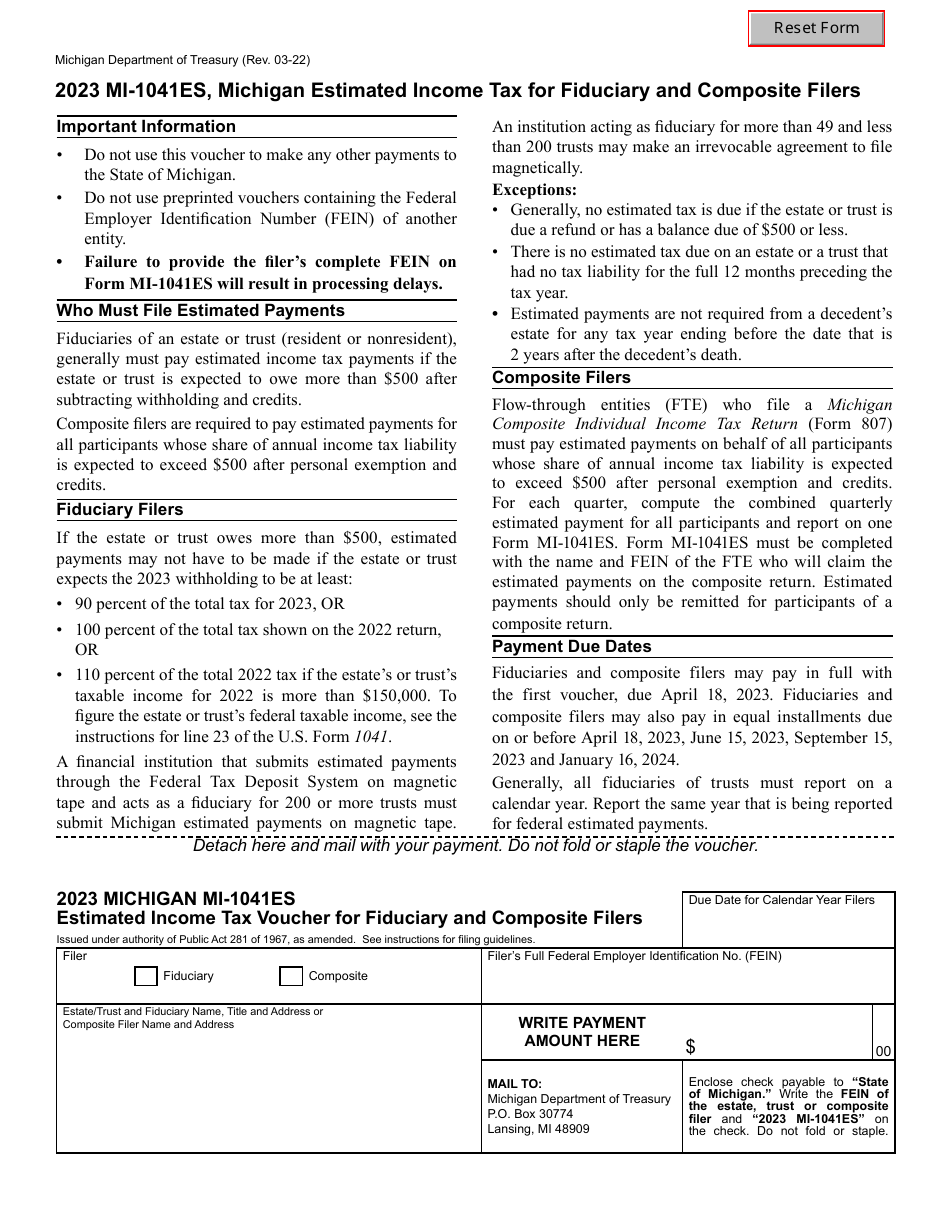

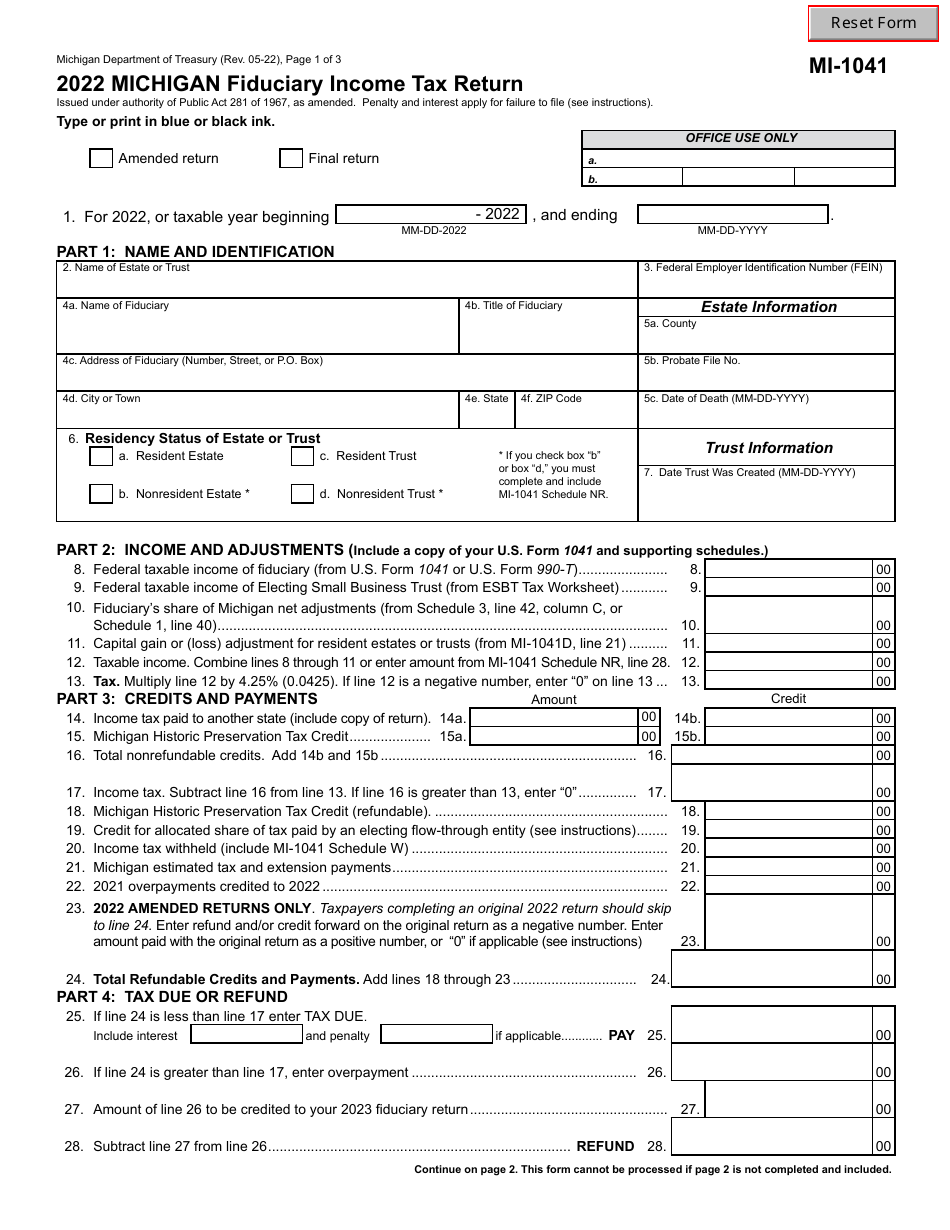

Form MI1041 Download Fillable PDF or Fill Online Michigan Fiduciary, Estimated tax penalty and interest calculator;

Source: hanniebsybilla.pages.dev

Source: hanniebsybilla.pages.dev

Mi Tax Forms 2024 Row Atlante, What is the deadline for filing michigan state taxes in 2024?

Source: freidaqnoellyn.pages.dev

Source: freidaqnoellyn.pages.dev

Michigan Estimated Tax Payments 2024 Jeanie Caitrin, Use our income tax calculator to estimate how much tax you might pay on your taxable income.

Source: kateybmaggee.pages.dev

Source: kateybmaggee.pages.dev

State Of Michigan Estimated Tax Payments 2024 Joell Madalyn, From revised state income tax rates to expanded benefits for retirees and.

Source: mabelbmaribeth.pages.dev

Source: mabelbmaribeth.pages.dev

2024 2024 Estimated Tax Form And Instructions Allie Bellina, Please answer the questions in the next sections.

Source: tabbyyportia.pages.dev

Source: tabbyyportia.pages.dev

Estimated Tax Payments 2024 Forms Pdf Download Prudy Carlynne, View my estimated tax payments;

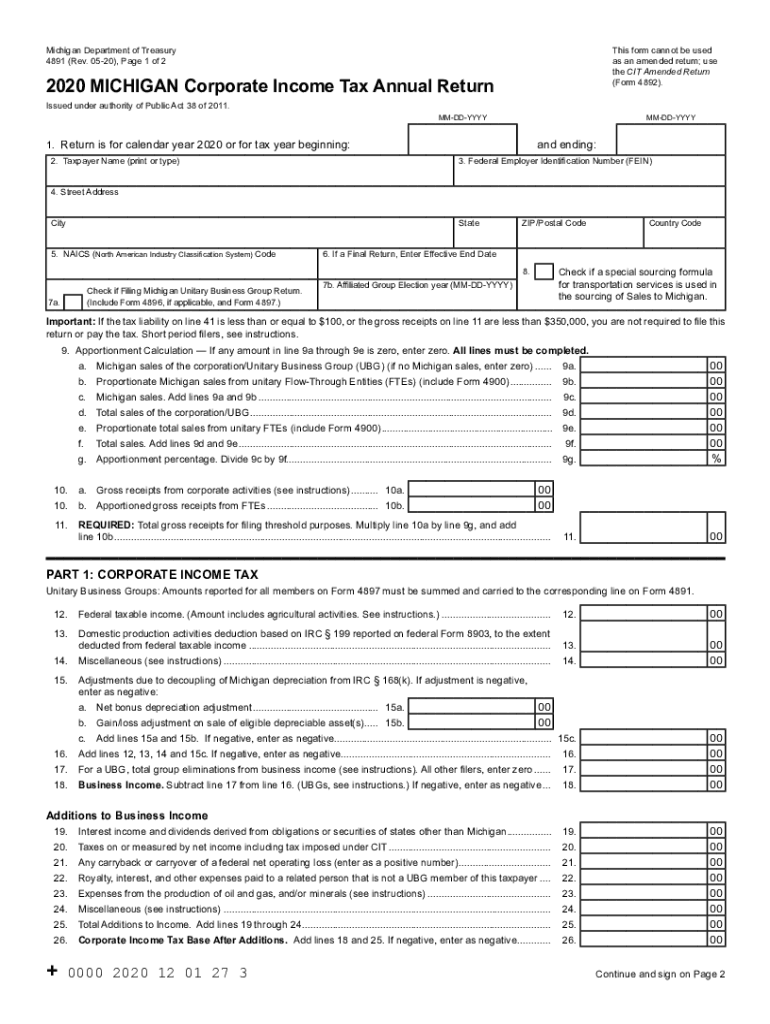

Source: www.signnow.com

Source: www.signnow.com

Michigan 4891 Instructions 20202024 Form Fill Out and Sign Printable, Following recent disasters, eligible taxpayers in tennessee, connecticut, west virginia, michigan, california and washington have an extended deadline for 2024.